Blogs

- Home

- Blog

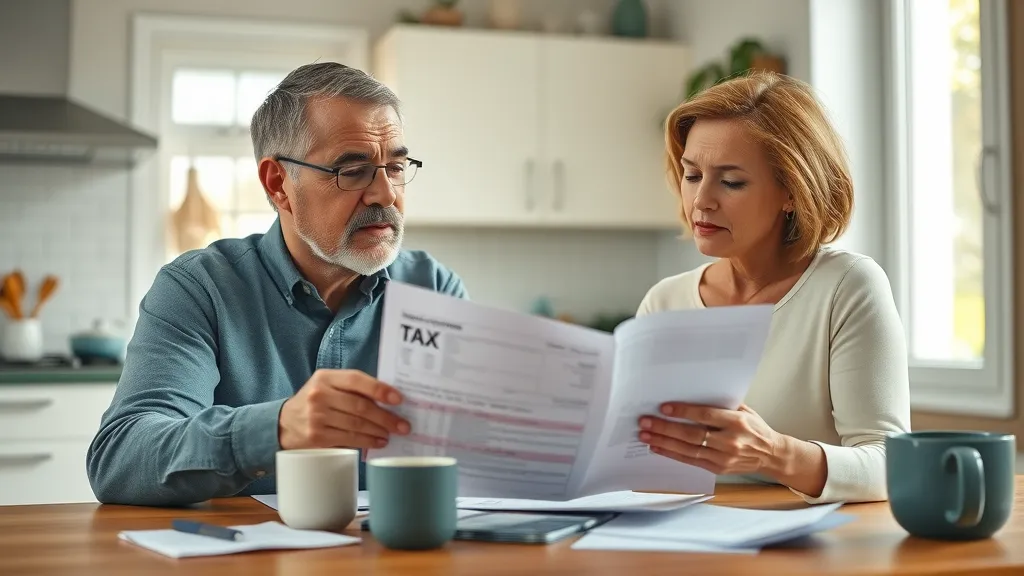

$31,500 vs. Itemizing: Should Rogers Homeowners Choose the 2025 Standard Deduction with Starner Tax Group Rogers

$31,500 vs. Itemizing: Should Rogers Homeowners Choose the 2025 Standard Deduction with Starner Tax Group Rogers TLDR: “$31,500 vs. Itemizing: Should Rogers Homeowners Take the 2025 Standard Deduction? Starner Tax Group Rogers helps homeowners in Rogers compare the 2025 standard…

Cryptocurrency Tax Reporting Just Got Serious: Starner Tax Group Rogers Explains 2025 IRS Rules for Bitcoin, NFTs, and Digital Assets

Starner Tax Group Rogers highlights that cryptocurrency tax reporting has become more detailed for the 2025 filing year, with the IRS increasing focus on Bitcoin, NFTs, and other digital assets. Understanding new IRS rules, including forms like 1099-DA, is essential…

Tax Refund Tips from Starner Tax Group Rogers: How to Get Your IRS Refund in 21 Days or Less

Starner Tax Group Rogers shares simple tax refund tips to help you file taxes accurately and get your IRS refund in 21 days or less by using e-file tax return and direct deposit IRS options. Avoid tax filing errors and…

Ultimate 2025 Tax Preparation Checklist: W-2s, 1099s, and More by Starner Tax Group Rogers

The Ultimate 2025 Tax Preparation Checklist from Starner Tax Group Rogers helps you collect all necessary tax documents, including W-2s, 1099s, and other vital forms, for a smooth tax filing experience. Perfect for individuals, freelancers, and small businesses aiming to…

Tax Services Northwest Arkansas: Avoid Costly Filing Errors Now

Did you know that nearly 20% of self-prepared tax returns contain costly mistakes? These common filing errors can lead to delayed refunds, steep penalties, or even IRS audits. If you’re in Northwest Arkansas, taking your tax prep seriously is critical…

Settling Offer In Compromise (OIC) issues northwest AR

Did you know? In 2022, over 54,000 taxpayers in the U.S. submitted Offers In Compromise, but only about 40% were accepted—and Arkansas’s acceptance rate falls even lower! This means thousands in Northwest AR are missing out on a fresh start…

Received an IRS Notice? Don’t Panic! A Guide to Responding Correctly

Did you know? More than 10 million IRS notices are sent out each year—are you ready to handle yours? If you’ve just received a letter from the Internal Revenue Service, you’re not alone. For many taxpayers across the United…

Struggling with amended tax returns? Here’s the Fix Now

Did you know that the IRS processes millions of amended tax returns every year—and most stem from mistakes that could have been avoided or corrected faster with the right help? If you’re feeling lost or anxious about fixing your tax…

Struggling with payment plan with irs? Here’s the fix

Did you know that over 3 million Americans are currently on a payment plan with the IRS? If you’re struggling with tax debt and feel overwhelmed by tax bills piling up, you’re not alone—and there’s a reliable way out….

I Got a Notice About a Tax Levy—Can I Stop It?

Did you know the IRS issues millions of tax levies each year? If you’ve received a notice about a tax levy, you’re not alone—and you can’t afford to ignore it. Tax levies can lead to the direct seizure of your…

Things to Do to Lower Next Year’s Taxes: Effective Year-End Tax Planning Tips

If you’re looking for things to do to lower next year’s taxes, Starner Tax Group offers practical year-end money moves focusing on maximizing deductions and tax credits. These tax planning tips help reduce your 2024 tax bill by carefully managing…

Is college financial aid taxable? A crash course for families

College can be expensive. According to the College Board, the average sticker price for tuition and fees at private colleges was $43,350 for the 2024–2025 school year. The average cost for tuition and fees for out-of-state students at public colleges…