The Problem

Tax season can feel overwhelming. Many taxpayers face confusion, stress, and costly mistakes when trying to manage their taxes on their own.

- Complex Rules: Constantly changing tax laws make it difficult to know what applies to your situation.

- Missed Deductions: You are likely overpaying the IRS, letting your hard-earned money slip through the cracks.

- Overwhelm and Fear of the IRS: The stress, anxiety, and fear that most people experience when dealing with taxes.

With Starner Tax Group, you get more than just tax preparation—you get a partner who works year-round to support your financial success.

The Solution

At Starner Tax Group, we make taxes simple, clear, and stress-free. Our team of enrolled agents and tax professionals take the guesswork out of the process, ensuring you stay compliant while keeping more of what you earn.

- Expert Guidance: We stay on top of changing tax laws so you don’t have to.

- Maximized Savings: Our proactive approach helps uncover every deduction and credit available to you.

- Peace of Mind: With accurate filing and audit support, you can feel confident knowing your taxes are in trusted hands.

With Starner Tax Group, you get more than just tax preparation—you get a partner who works year-round to support your financial success.

Services Section

Tax Preparation

Taxes don’t have to be overwhelming. We provide accurate, timely tax preparation for individuals and businesses, ensuring every deduction and credit is claimed. With expert guidance, we take the guesswork out of filing so you can feel confident in your return.

Tax Consulting

Planning ahead saves money and stress. As experienced tax consultants, we help you make smart financial decisions year-round, from business strategies to personal planning. Our tailored advice ensures you minimize liabilities and maximize opportunities.

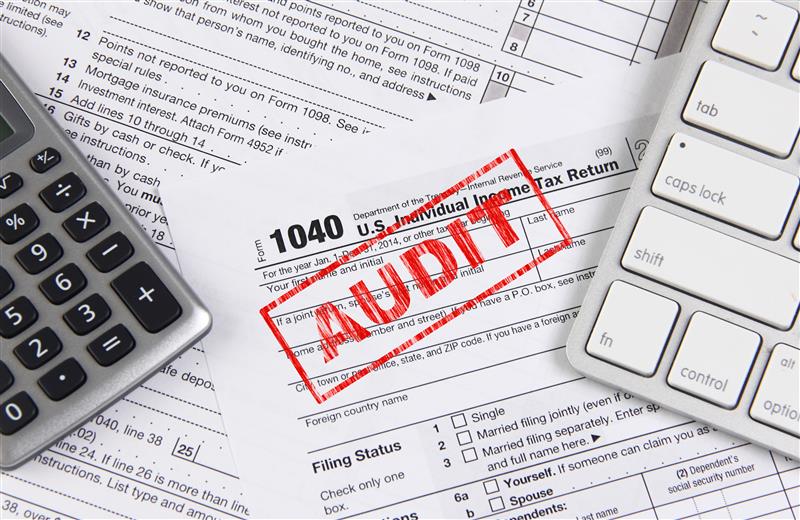

Enrolled Agent Services

IRS issues can be intimidating. As federally licensed Enrolled Agents, we represent you directly in audits, back tax matters, and collection cases. By handling all IRS communications, we work to reduce stress and protect your

financial interests.

The Benefits of Working with Starner Tax Group

Discover the distinct advantages and peace of mind you gain by partnering with our expert team.

Maximize Your

Returns

Our meticulous tax preparation goes beyond simple filing. We delve deep to uncover every deduction and credit you're entitled to, ensuring you keep more of your hard-earned money. Experience the confidence of knowing your return is not just accurate, but optimized for your financial benefit.

Achieve Financial

Clarity

Through dedicated tax consulting and proactive planning, we transform tax season from a dreaded annual event into an opportunity for strategic growth. Gain a clear understanding of your financial landscape, make informed decisions, and build a solid foundation for your future goals.

Expert Representation & Peace of Mind

Facing the IRS can be daunting, but with our Enrolled Agent services, you're never alone. As federally licensed tax practitioners, we provide powerful representation, resolving complex issues and negotiating on your behalf. Rest easy knowing you have an expert advocating for your rights and protecting your interests.

About Us

Starner Tax Group is licensed in AR

and specializes in Taxes.

services for business owners, executives,

and independent professionals.

The Process

Step 01

Schedule a Consultation

Ready to take control of your taxes and financial future? Our process begins with a simple, no-obligation consultation. During this initial meeting, we’ll listen to your unique needs, assess your situation, and discuss how our expertise can best serve you—whether it’s for tax preparation, business services, or resolving IRS issues. It’s the perfect opportunity to ask questions and discover the peace of mind that comes with professional guidance.

Step 02

We Do The Work

Once you’ve entrusted us with your financial details, consider the heavy lifting done. Our team of experienced Enrolled Agents and tax professionals meticulously gather and review your documents, identify every applicable deduction and credit, and prepare your returns with precision. We handle all the complexities, ensuring accuracy and compliance so you don’t have to. You can relax, knowing your taxes are in expert hands.

Step 03

Enjoy The Outcome

The best part? The confidence and peace of mind that comes with knowing your taxes are handled correctly. Whether it’s maximizing your refund, minimizing your tax liability, or successfully resolving an IRS issue, our goal is your financial well-being. We’ll present your completed returns, explain everything clearly, and remain available year-round for any follow-up questions or planning needs. Enjoy the outcome of expert guidance!

The Difference is Clear: Why Choose a Dedicated Firm?

When it comes to your taxes, expertise and a personal relationship matter. See how our approach compares to the large, seasonal chains.

With Us

- Our team consists primarily of Enrolled Agents (EAs), the highest credential awarded by the IRS. All our preparers complete extensive continuing education annually to stay experts in their field.

- We are open all year to provide tax planning, answer questions, and help you with any IRS notices or audits you may receive long after April 15th. Your tax professional is always just a call or email away.

- You will work with a dedicated professional who gets to know you and your unique financial situation. We build long-term relationships to better serve your financial goals year after year.

- Our focus is on providing trusted advice tailored to your best interests. Our success is measured by your financial well-being, not sales quotas for add-on products.

- We specialize in handling complex tax situations, including for small businesses, freelancers, rental properties, and investments. We have the expertise to find every deduction and credit you're entitled to.

With National Firms

- Often staffed by seasonal preparers who receive minimal initial training. You are not guaranteed to work with a credentialed expert like an EA or CPA.

- Many locations are seasonal franchises that close or operate on severely reduced hours after tax season, making it difficult to get help or answers when you need them most.

- High employee turnover is common. You will likely work with a different person each year, forcing you to explain your financial history over and over again.

- Often a volume-based business model focused on processing returns as quickly as possible. You may experience pressure to purchase ancillary products like refund anticipation loans.

- Primarily designed for high-volume, simple W-2 returns. May lack the specialized knowledge required for more complex or nuanced financial scenarios.

Frequently Asked Questions

What documents do I need to bring for my tax appointment?

You should bring all documents related to your income and expenses for the tax year. This includes W-2 forms from your employer(s), 1099 forms for freelance or contract work, investment income statements (1099-INT, 1099-DIV, 1099-B), and any forms related to retirement income or Social Security. You should also gather records of significant expenses that might be deductible, such as student loan interest, charitable contributions, medical expenses, or business-related costs.

Why do I owe more or receive a smaller refund than last year?

Can I file an extension if I need more time?

Yes, you can file an extension with the IRS to get an additional six months to file your return. However, it’s crucial to remember that an extension to file is not an extension to pay. If you expect to owe taxes, you must estimate the amount and pay it by the original deadline to avoid penalties and interest.

Can I file an extension if I need more time?

What happens if I get audited?

Tax Blog

$31,500 vs. Itemizing: Should Rogers Homeowners Choose the 2025 Standard Deduction with Starner Tax Group Rogers

$31,500 vs. Itemizing: Should Rogers Homeowners Choose the 2025 Standard Deduction with Starner Tax Group Rogers TLDR: “$31,500 vs. Itemizing: Should Rogers Homeowners Take the 2025 Standard Deduction? Starner Tax Group Rogers helps homeowners in Rogers compare the 2025 standard…

Cryptocurrency Tax Reporting Just Got Serious: Starner Tax Group Rogers Explains 2025 IRS Rules for Bitcoin, NFTs, and Digital Assets

Starner Tax Group Rogers highlights that cryptocurrency tax reporting has become more detailed for the 2025 filing year, with the IRS increasing focus on Bitcoin, NFTs, and other digital assets. Understanding new IRS rules, including forms like 1099-DA, is essential…

Tax Refund Tips from Starner Tax Group Rogers: How to Get Your IRS Refund in 21 Days or Less

Starner Tax Group Rogers shares simple tax refund tips to help you file taxes accurately and get your IRS refund in 21 days or less by using e-file tax return and direct deposit IRS options. Avoid tax filing errors and…

Tax Services Northwest Arkansas: Avoid Costly Filing Errors Now

Did you know that nearly 20% of self-prepared tax returns contain costly mistakes? These common filing errors can lead to delayed refunds, steep penalties, or even IRS audits…

Settling Offer In Compromise (OIC) issues northwest AR

Did you know? In 2022, over 54,000 taxpayers in the U.S. submitted Offers In Compromise, but only about 40% were accepted—and Arkansas’s….

Received an IRS Notice? Don’t Panic! A Guide to Responding Correctly

Did you know? More than 10 million IRS notices are sent out each year—are you ready to handle yours?…